Second Time Around

Last November, the mood was tense at a Sotheby’s auction in Geneva as five bidders competed for Patek Philippe’s famous 1932 Henry Graves Supercomplication pocket watch. The masterpiece with 24 complications produced for the American banker held the title of the world’s most complicated watch until Patek itself sured it in 1989. When the Graves last sold in 1999 for $11 million, setting a record for the highest price ever paid for a watch at auction, it slipped through the fingers of Patek Philippe’s owner Philippe Stern. Observers speculated that the Stern family would not allow that to happen again. The death of the watch’s 48-year-old owner, Sheikh Saud bin Mohammed Al-Thani of Qatar, just days before the sale, added another twist. After a suspenseful 15 minutes, the piece earned a new spot in the record books when an anonymous party bid $24 million, smashing the presale estimate of about $14.5 million. If the Graves appears in a display at Geneva’s Patek Philippe Museum, we might have a clue to the new owner’s identity.

Such stratospheric sales are just one aspect of a growing aftermarket for mechanical watches that is exciting collectors and heating up across the globe. It is an ever-present reminder that fine pieces retain much of their value and sometimes rise in price with the years. Naturally, the rare and prestige pieces promise better investment potential. So mechanicals, particularly complicated mechanicals in mint condition and bearing coveted brand names, are the grail watches of the vintage realm. And, yet this craft, so rooted in history, has modern technology to thank for the recent resurgence on the resale market.

The Internet was a game changer, providing a vast resource for researching brands and models and their nuances and evolutions, allowing motivated collectors to zero in on exactly what they're looking for before they even an auction house or dealer. The information superhighway elevated everyone's—including the auction experts'—scholarship in the field.

Thanks to the Internet and an abundance of specialty watch blogs, such as Hodinkee, and forums, including PuristSPro, doing that homework is easier than ever. Even though we may still associate auctions with closed rooms filled with paddle-wielding proxy bidders for elite collectors, the auction world is not only about trophy watches. In fact, the experience has been dramatically transformed with online bidding and expanded services, such as personalized consulting and shopping services, as well as on-demand purchasing. Meanwhile, private dealers no longer need brick-and-mortar stores, and online buying/selling services have popped up to serve modern-day collectors, which includes a growing number of 20- and 30-somethings, who have discovered the cool factor of vintage mechanical timepieces.

"The Internet is what really changed the market," says Matthew Bain, a veteran Miami-based private dealer who closed his physical store in 2006 and set up shop online. "That really brought in a whole new type of collector. Before the Internet, there were maybe only a half-dozen top American collectors, and you knew who they were. Now there are hundreds." Bain notes that one of the main advantages of buying through a reputable dealer compared to an auction house is that the watches are backed by a one-year mechanical warranty, so you have a guarantee, plus you can return it right away if you are unhappy.

"Technology definitely changed the whole landscape," agrees Saori Omura, director and watch expert at Antiquorum USA, the American division of the international auction house that specializes in watches and clocks. "We were one of the first auction houses to offer online bidding about 10 years ago. In the beginning, people were a little hesitant about buying something expensive online. Now, over 50 percent of buyers are bidding online, especially U.S. buyers. They can see the auctioneer on their screens at home or in their office, and know exactly what's going on in the room." Consequently, fewer people may be inclined to show up in person these days, especially if they desire anonymity.

Still, it's always advisable to see pieces in person to evaluate firsthand before bidding if possible. At a New York auction preview event last fall, Omura noticed not only a shift to a younger demographic but also a social vibe. "We saw a lot of young guys who seemed to know each other," she explains. "It became more of a social event, a get-together."

Not that old-guard auction houses are looking to expand their watch services and flex their muscles with blockbuster sales. Christie's also hosted a Patek-themed auction in Geneva last November to commemorate the brand's 175th anniversary milestone. For that sale, the auction house assembled a collection of 100 symbolic vintage Patek Philippe timepieces dating from the early 19th century through the 1980s that chronologically tell the story of the fabled brand. More than 300 international collectors showed up to bid, establishing nine new world auction records. A pink gold Reference 2499 perpetual calendar chronograph from 1951 was the top lot selling for $2,678,425. Another high achiever was a 1930 Reference 130 single button split-seconds chronograph made for William E. Boeing, which sold for more than a half million dollars.

"We're seeing Patek Philippe do better than ever," says Reginald Brack, senior vice president and international head of retail for watches at Christie's, who predicts that prices and demand for vintage Pateks will soar even higher. He also mentions a 2013 sale to mark the 50th anniversary of the Rolex Daytona when all 50 lots set world records. "Whether it's Patek Philippe, Rolex or other brands, their new current models are so different and evolved from their vintage pieces—we see a real retreat to the vintage market. There are fewer and fewer of these great vintage pieces that remain in exceptional condition, and those really exceptional pieces will only continue to appreciate over time."

Katharine Thomas, vice president and head of watches at Sotheby's attributes Patek's ongoing unprecedented auction results to their commitment to their history. "It is one of the most important reasons why they remain at the forefront," she says.

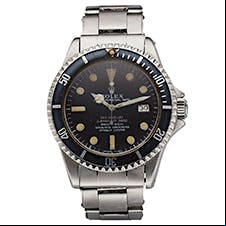

Then, there's Rolex. "Rolex has the iconic status—it's much better known as a brand name with much broader appeal," adds Thomas. "It's interesting from our perspective that often, vintage Rolexes from the '60s and '70s—Daytonas that were purchased for not-huge prices—are now selling into the five and six figures, and, as of late, seven figures. That's an incredible story."

Whether you are eyeing the secondary market or looking to acquire a new timepiece, value retention is a priority for those who consider a watch an investment. Experts advise buying with an exit strategy in mind, and doing your homework on which brands and models offer the best returns should you choose to sell.

And if your pockets aren't quite deep enough for a rare vintage Patek Philippe or Rolex, Brack suggests classic makers such as Vacheron Constantin as strong value propositions. "You can buy a beautiful vintage Vacheron chronograph in great condition for a fraction of the price of a cousin Patek Philippe," he says. "It doesn't have to be world-record setting, just in great condition and fresh to market." His advice: Do your homework and find the best-condition specimens you can.

Part of the appeal of vintage and pre-owned modern watches among this younger generation, she speculates, is their desire to stand apart from the crowd with a watch that no one else has. "Because everyone has a phone, you don't really need a watch for time anymore," explains Antiquorum's Omura. "It's more of a fashion statement or status thing. Individuality is something that the younger generation likes."

Coinciding with the shift from buyers in their mid-40s to 60s to buyers in their 20s and 30s has been a growing interest in sport watches from the 1970s from more approachable brands such as Heuer Autavia. While the famous Heuer Monaco has been collectible for years now, it's out of reach for many at this point. Omura has noticed that other models from the same period are gaining traction. "Some are a bit quirky and colorful, and people are interested because they come in so many different variations."

|

Last fall, Antiquorum sold Philippe Cousteau's 1967 Rolex Sea-Dweller Reference 1665 for $183,750, a sum that far exceeded estimates thanks to a bidding war that ensued given that it is one of the earliest known Sea-Dwellers and the fact that it was worn by the filmmaker and oceanographer who was the son of the legendary Jacques Cousteau. In the same sale, a private collection of 14 A. Lange & Söhne timepieces each sold above estimates garnering a total of $476,875. "The craftsmanship and quality of finish is on par with Patek, Vacheron and other high-end Swiss watchmakers," says Omura. "Lange has great potential."

Sotheby's, which launched online bidding five years ago, has also noticed a steady increase in online action and expanding demographics. "We're seeing an entirely new element of bidders both in of geography and age," says Thomas. "The Internet is also a great tool to better intersect with clients," she adds. "They have the ability to view pieces online under huge magnification, read condition reports and interact with the pieces more personally than through a printed catalog. It makes them more savvy than ever."

Christie's rolled out a dedicated private sales program last year, so interested buyers and sellers are no longer confined to scheduled auction events. "Watch collecting can almost become an addiction—in a good way," explains Brack. "Guys are constantly trying to improve their collections, to find new pieces and sell old ones, and many don't want to be tied to an auction schedule." He describes the new service as "ultimate personal shopping" that employs Christie's global network to find specific pieces you may be seeking or to help you sell a high-profile watch privately behind the scenes.

Last summer, Christie's also opened an online watch shop where people can buy on demand at fixed prices, learn about timepieces and watch videos hosted by Christie's experts to educate themselves. The shop recently offered a collection of mint-condition vintage Omegas from the 1960s through the '90s at sharp prices. "Certainly with vintage Omegas, it's really skewed to younger, entry-level collectors, but not exclusively," says Brack. "They tell us, ‘I don't have deep pockets but I want to get into collecting, what brand can I start with?' We generally say you can get a phenomenal watch at a reasonable price when you get into vintage Omega."

"You can still get a killer example of an Omega Speedmaster for $2,500 to $5,000," agrees Bain. "There are some very affordable vintage watches that are great." Rolex GMTs and Submariners are also popular choices. "They were a lot more affordable in the '90s, but no one was buying these things then." He recalls selling pieces for $700 to $800 that now trade for 10 times that amount.

Sotheby's has also gotten into the retail game, hosting two pop-up shops last summer—one at the Pebble Beach Concours d'Elegance and one on the 10th floor of its New York City headquarters. "You can walk in with a credit card or purchase online," explains Thomas. "It's similar to the wine department which sells through auction but also has a store onsite for walk-in purchases. It makes collecting much easier for clients."

|

The more convenient and accessible buying experience combined with growing legions of watch collectors has spurred increased demand for vintage and pre-owned pieces at all levels of the market. At the pinnacle, the proliferation of ultra-high-net-worth collectors is driving those record-breaking sales. But regardless of price, several experts point out that condition is everything in today's market. "Watches in mint condition are trending very well and performing at a high level," says Bain who specializes in high-grade vintage pieces from premier brands such as Patek Philippe and Rolex. However, he also sees strength in subsidiary brands such as Omega, Universal Genève and Longines. "If it's in mint condition, there are a lot of hungry buyers out there for anything right now."

While they may not have the historic track record of Patek Philippe or Rolex, modern pre-owned watches bring another dimension to the market, one that can appeal to bargain hunters. "When you buy anything at retail, once you walk out of the store, generally, the value falls for the secondary market," says Brack, who notes some amazing values in pre-owned, unworn timepieces from lesser-known brands such as Ulysse-Nardin. "Even with emerging brands, if you can find a great example that is pre-owned, you will be making good investment and certainly saving quite a bit of money."

Contemporary artisanal brands, such as F.P. Journe and Greubel-Forsey, present the chance for collectors to connect with living watchmakers. "It's really amazing to have the opportunity to interact with someone behind the brand," says Thomas. "In art, you may know the story about the artist, but with watches, it's more typically about a brand rather than an individual, so it's really neat to have a face behind the brand."

In 2012, private equity veteran Hamilton Powell launched Crown & Caliber, inspired by a friend's painful experience selling his Patek Philippe. The online service is dedicated to making the process of selling a pre-owned watch as simple as buying one with a level of security and an assurance of fair pricing. Sellers request a quote on the website, after which they are sent an estimated value range. The seller receives pre-paid packaging to ship the watch with insurance. Once Crown & Caliber receives the watch, they assess condition and make a final offer. If you agree, you receive payment.

This model is similar to Circa, which launched in 2001 by three estate jewelry experts to fill the gap between elite auctioneers and lowbrow pawnshops for those looking to liquidate their jewels and timepieces. Timepieces for up to 30 percent of Circa's business. "The vast majority of luxury watches won't find a home in an auction," says Natasha Cornstein, director of brand management, who points out the advantages of selling on demand. "They may have bought their first Rolex and want to move on to more complicated watches or they started with an entry-level watch and want to upgrade," says Cornstein. "It's a sell-to-buy opportunity. You can purchase something, use it and enjoy it, then move on to your next pursuit rather than letting it languish in a drawer."

Conversely, in the auction world, a timepiece discovered unused after decades is coveted for its mint condition compared to most pre-owned watches that bear the scars of wear and tear. "You have to understand that vintage pieces will have some sort of history because it's very unlikely to find something that's been sitting in a drawer for 50 years," says Thomas. "If you do, it's probably worth twice as much as one that led a life." Still, it is precisely that patina and provenance, the life it lived and the stories it could tell, that endow a vintage watch with soul, making it entirely unique.

Laurie Kahle writes frequently for Cigar Aficionado on watches and travel.